Shared Paternity Leave and Pay gives new parents and adoptive parents the opportunity to share the Maternity Leave and Pay that an eligible woman is entitled to. This gives the opportunity for a new father or partner of the mother to get to know their new baby in the first months of its life and share the care, supporting both parents as they enter onto the life-changing path of parenthood. At first glance it looks like a fantastic step forward with fathers being able to take an active role in the care of their new child.

However, all is not as you might first imagine. The father will only be in receipt of Shared Paternity Pay (if he’s eligible) from his employer which at 2017 figures is £140.98 per week. With the mother being either off work at the same time, or not employed many new families find that this is a financially impossible situation and sharing paternity leave is not an option they can afford to take.

The uptake of Shared Paternity Leave is not promising. The TUC have estimated around 40% of working parents will not be eligible because either the mother doesn’t have a paid job, or the couple do not meet the requirement of being with the same employer for at least 26 weeks by the end of the 15th week before the due date or adoption match. In addition, a survey of 1,000 people by My Family Care and Workingmums.co.uk found that 41% of couples would not consider Shared Paternity Leave. One in four were unaware of the changes, while nearly one third (32%) were confused with how the process works.

So, let’s try to explain how this works, and how new parents and adoptive parents qualify for Shared Paternity Leave.

Get a coffee, grab a snack and find a comfy chair!

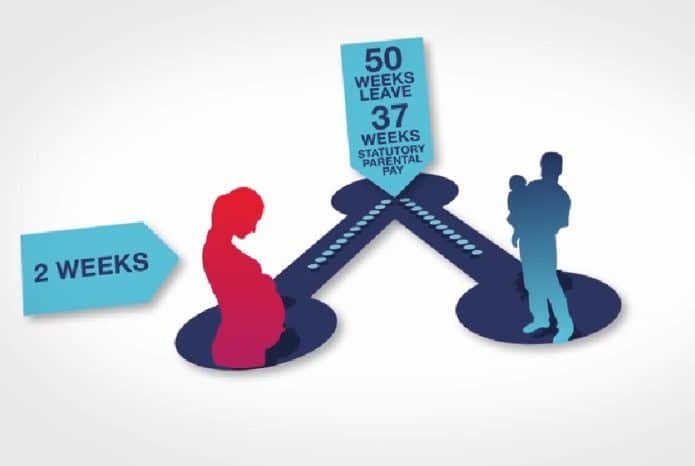

First, a quick recap. Statutory Maternity Leave is up to 52 weeks. The first 26 weeks are called Ordinary Maternity Leave and the remaining 26 are referred to as Additional Maternity Leave. Usually the earliest leave can start is 11 weeks before the baby’s due date. A woman must take a minimum of two weeks after the birth of the baby, or 4 if she works in a factory.

Statutory Maternity Pay is paid for up to 39 weeks. The first 6 weeks are 90% of your average weekly earnings, and the remaining 33 weeks are paid at a rate of either £140.98 or 90% of your average weekly earnings, whichever is the lower.

Shared Paternity Leave and Pay is based on the Maternity Leave and Pay allowances.

Once a woman has taken stated her Statutory Maternity Leave, had her baby, and taken the two or four weeks she is required to take after the birth she can stop her Maternity Leave, and what remains of the 52 weeks leave and 39 weeks pay can be shared across both parents.

However, there are several qualifying conditions that both parents must fulfil.

- Responsibility for the child must be shared between the mother and husband, wife, civil partner or joint adopter, the child’s other parent, or partner (who must live together)

The Mother:

- Must be entitled to either Maternity or Adoption Leave, or Statutory Maternity Pay or Statutory Adoption Pay or Maternity Allowance

- Must have given notice to reduce their Maternity/Adoption Leave or their Maternity Pay/Maternity Allowance

The Father or Partner:

- Must be an employee

- Share primary responsibility for the child with the mother or other parent at the time of the birth or adoption placement

- Have notified the employer and provided correct information

In addition, the Father or Partner:

- Must have worked for the same employer for at least 26 weeks at the end of the 15th week before the due date (Called the ‘Continuity of Employment’ test)

- Must have worked at least 26 weeks of the 66 weeks before the baby’s due date (or the week you were matched with the adopted child) and have earned at lease £390.00 during 13 of those 66 weeks. These do not need to be consecutive weeks (Called the ‘Employment and Earnings’ test)

- Must still be employed by the same employer at the start of the first period of Shared Paternity Leave

How Shared Paternity Pay and Leave Works

Shared paternity leave can be taken in up to three ‘chunks’ by each parent, a total of 6 across the two. It must be taken by the first birthday of the baby or within one year of adoption.

To start Shared Paternity Leave or Pay, a mother must end her maternity leave for (Shared Paternity Leave) or her Maternity Pay (for Shared Paternity Pay).

Shared Paternity Leave can only start once the baby has been born or placed for adoption.

How to Get Started with Shared Paternity Leave and Pay

To start Shared Paternity Leave, the Mother (or person getting Adoption Leave) must:

- return to work, which ends any maternity or adoption leave

- give their employer ‘binding notice’ of the date when they plan to end their leave (you can’t normally change the date you give in binding notice)

For Shared Paternity Pay to start, the Mother (or the person getting adoption pay) must

- Give their employer binding notice of the date when they plan to end any maternity or adoption pay.

- Follow the rules for starting Shared Paternity Leave and Shared Paternity Pay

- Give your employer at least 8 weeks’ written notice of your leave dates

Examples of how Shared Paternity Leave and Pay works:

A mother and her partner are both eligible for Shared Paternity Leave and Shared Paternity Pay. The mother ends her Maternity Leave and Pay after 12 weeks, leaving 40 weeks available for Shared Paternity Leave and 27 weeks available for Shared Paternity Pay. The parents can choose how to split this.

A woman decides to start her maternity leave 4 weeks before the due date and gives notice that she’ll start SPL from 10 weeks after the birth (taking a total of 14 weeks maternity leave). She normally earns £200 a week. She’s paid £180 (90% of her average weekly earnings) as SMP for the first 6 weeks of maternity leave, then £140.98 a week for the next 8 weeks. Once she goes onto SPL, she’s still paid £140.98 a week.

To help with this complex process HMRC provide several helpful links.

Shared Parental Leave and Pay – Overview. This also contains links to the forms that need to be filled in to request Shared Paternity Leave and Pay for maternity, adoption and parental order surrogacy.

https://www.gov.uk/shared-parental-leave-and-pay/overview

Maternity Leave and Pay Calculator. This will also determine eligibility for Shared Paternity Leave and Pay. Follow the link below:

https://www.gov.uk/pay-leave-for-parents

ACAS also have lots of helpful information, which includes a practical guide for employers and employees, and lots of letter templates and forms.

http://www.acas.org.uk/index.aspx?articleid=4911